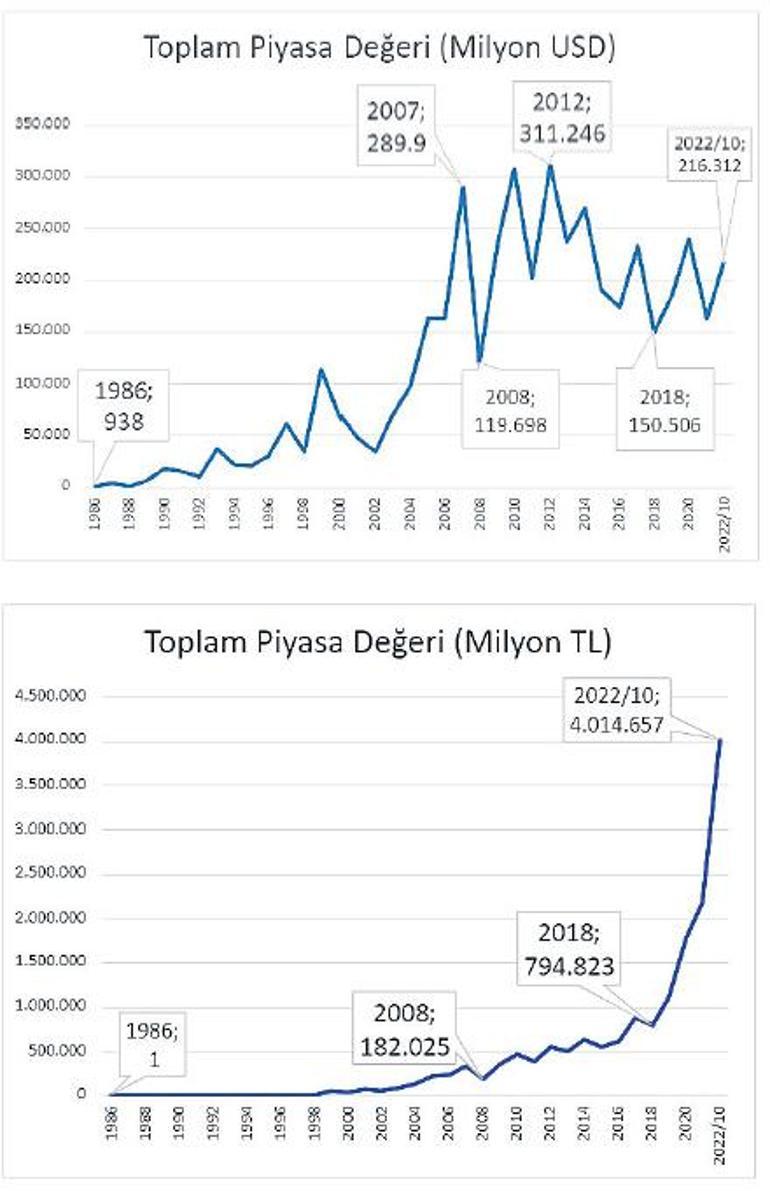

Whereas the market worth of 504 corporations traded on Borsa Istanbul is 4 trillion 14 billion liras, it’s equal to 216 billion {dollars} on a greenback foundation. The burden of the holdings has elevated in affecting the index. THY, then again, ranked first by way of impression on the index.

Borsa Istanbul is experiencing one of many highest will increase in TL phrases within the final 20 years. The index has risen 95 p.c because the starting of the 12 months. This fee of improve was final noticed after the 2008 disaster. The rise within the index in TL was larger than the inflation. In greenback phrases, there was an outflow of 40 p.c.

So, which shares rose within the index? The shares included within the Inventory Alternate 100 Index have modified 4 instances because the starting of the 12 months. Shares that met the index standards differed on 1 January, 4 April, 7 July and 1 October. Nevertheless, there was no change in the principle shares with a excessive weight within the index.

At first of the 12 months, Turkish Airways’ weight on the index was 2.95 p.c. Within the interval beginning with April, it rose to three.96 p.c. Whereas it elevated to five.65 p.c within the interval beginning with July, the speed elevated to six.93 p.c within the interval beginning with October. Turkish Airways is growing its weight on the index daily. This example causes the index to be extra affected by the ups and downs within the inventory. Whereas THY has turn out to be the share that impacts the index essentially the most, it additionally considerably impacts the motion of the index with its declines and rises.

SASA’s prime 10 entry

SASA’s weight within the BIST 100 Index was 2.27 p.c in January. In terms of the interval beginning with April, it was 2.09 p.c. In July, its weight within the index elevated to 2.80 p.c. Within the final interval that began with October, SASA rose to the seventh place among the many shares that the majority affected the index. It surpassed Koç Holding and Sabancı Holding with its weight. The rise within the weight of the inventory throughout the scope of the index additionally attracted the eye of market gamers. It was the inventory with the very best quick promoting on October sixth. The excessive volatility within the inventory triggered Borsa İstanbul to take it into the scope of the measure. With the intention to forestall investor grievances in SASA shares, Borsa İstanbul will impose a ban on quick promoting and margin buying and selling from the start of the session on October 17, 2022 till the top of the session on November 16, 2022. These measures are aimed toward stopping actions that trigger excessive volatility by shopping for on margin or promoting quick. These measures might have an effect on the buying and selling quantity of the inventory. Nevertheless, the choice will present a calmer course for buyers.

Borsa Istanbul measures

Borsa İstanbul carefully screens the volatility in shares to guard buyers. The fluctuation margins of every inventory could also be totally different in line with its personal concord. In case of fluctuations past the conventional, measures are taken to reduce potential investor grievances.

In accordance with the parameters decided by Borsa Istanbul, if there’s a excessive fluctuation within the inventory, gradual measures are implement. The measures that may be implement consist of 5 levels. The stated measures are:

one) First stage ‘Quick Promoting and Credit score Transaction Ban’ measure for 1 month.

2) Second stage ‘Gross Barter’ measure for 1 month.

3) Third stage ‘Order Package deal (Restriction of Market Order and Market to Restrict Order Entry, Prohibition of Order Cancellation, Order Amount Discount and Order Value Worsening and Restriction of Order Assortment Data Broadcasting)’ measure for 1 month.

4) Fourth stage ‘Buying and selling with Single Value Technique’ measure for 1 month.

5) Fifth stage ‘Restriction of Order Transmission Channels (Web Order Ban)’ measure for 1 month.

Newest developments in shares

Eregli continues to be common

Whereas Eregli was the biggest share on the index till July, Turkish Airways left the management within the interval beginning with October. Now, it’s the second inventory that has essentially the most impression on the index, after Turkish Airways, with 5.51%.

Şişecam retained its place within the prime 10

As of October, Şişe Cam ranks fifth among the many shares with the very best weight within the index. All year long, the rating of weights on the index remained within the vary of 4-5. The inventory continues to take care of its affect on the index.

Until there’s a important change within the routine, it ought to be anticipated to take care of this weight all year long.

The variety of holdings is growing

The variety of holdings began to extend among the many shares with the very best weight within the index. Whereas Koç Holding’s weight within the index is 3.20 p.c, Sabancı Holding, which entered the listing later, is 3.18 p.c. Sabancı Holding entered the highest 10 within the interval beginning with July.

Ford Otosan is just not within the prime 10

Whereas Ford Otosan was within the ninth place within the listing beginning with January, it couldn’t enter the highest 10 within the listing that began in October. Ford Otosan and Garanti Financial institution had been among the many prime 10 shares that affected the index, whereas SASA and Sabancı Holding took their place.

Turkcell dropped in rating

Turkcell was among the many prime 4 within the listing of shares that affected the index within the interval that began with final January. The inventory steadily fell again within the rankings within the following intervals. Within the interval that began with October, it fell to the tenth place within the rating.

How has the state of affairs modified in banks?

The weights of financial institution shares on the index have modified. Garanti Financial institution and Akbank had been the banks with the very best weight on the index initially of the 12 months. Akbank maintained its place within the prime 10 within the final 4 index modifications. Nevertheless, Garanti Financial institution’s weight on the index has decreased because the starting of the 12 months and has not been among the many prime 10 shares. The share’s impression fee on the index decreased to 1.44 p.c.

.

#THY #flying #excessive #inventory #market