Tuesday, October 25, 2022

A drop of water provides life, however what occurs if it floods? It takes life… Cash is like water, an excessive amount of isn’t a ability. Its supply and type of use are vital. The cash provide that’s elevated with out being attentive to these in an financial system results in inflation. This case, which appears good for households and firm homeowners within the brief time period, turns right into a nightmare within the medium and long run.

Sadly, AKP needs to win the elections by making a flood of cash, however it’s inflicting very harmful issues for the nation’s financial system. Let’s clarify step-by-step:

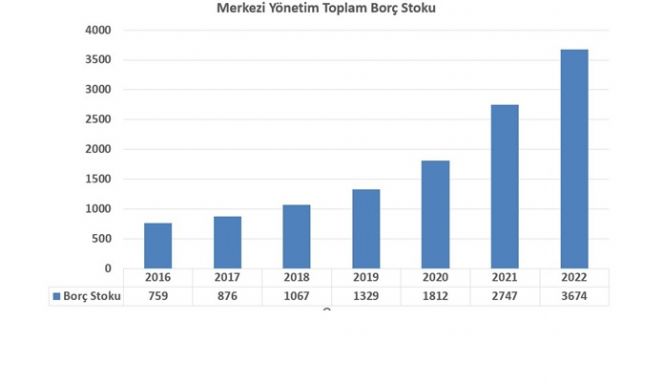

1- The AKP reached the most important debt inventory figures within the historical past of the Republic. The chart under reveals us the state of affairs in recent times very clearly.

After 2002, when the AKP was in energy, which you don’t see within the graph, the debt determine of 2003 was 283 billion TL, and in 2018 the determine exceeds 1 trillion. For the reason that Republic was declared in 1923, the entire debt of all governments has exceeded 3.6 trillion TL as of September 2022. What are the implications of this?

a-They may apply to the residents to pay this debt, and everybody, together with our kids, will work to scrub up this mess.

b- Because the debt will increase, CDS (Threat premium) will go up, rising the rate of interest and inflation, relying on the change price.

2-Debt isn’t sufficient, the Central Financial institution is beginning time beyond regulation to show the wheel and save the picture. Whereas reducing the rate of interest raises the speed and creates inflation, it additionally prints free cash. See under, we are able to see the course of the M1 cash provide (cash in circulation and cash in demand accounts).

In January 2021, M1 was 1.1 trillion TL. In January 2022, the determine was 2.1 trillion. In October 2022, it exceeded 2.8 trillion. In different phrases, the amount of cash elevated by 140% in comparison with 2021 and 40% in comparison with January 2022.

If extra money is printed than the expansion price in an financial system, you’ll encounter inflation. Our inflation continues to rise because of each value will increase because of scarcity of products and the printing of cash. The amount of cash has became a flood, however is the state of affairs of the citizen enhancing? No… As a result of this cash is being transferred to the oligarchs (usurers + AKP elites).

The cash faucet has now been opened, and we’ve seen its reflection in life within the improve within the ceiling of KGF loans. The assertion made by Nabati the opposite day was one other knowledge displaying this financial enlargement. What was the topic? It was reported that the Treasury Curiosity Supported Mortgage Package deal, amounting to TL 100 billion, for use via Halkbank to satisfy the financing wants of tradesmen and craftsmen, got here into impact.

Do not get me flawed, we do not have an eye fixed for the loans given to the tradesmen, however what does it do in case you are organising a system that can finish the buying energy of the residents, minimize the enterprise of the tradesmen, after which debit them? As we mentioned above, the rising amount of cash causes inflation and the issues are solely multiplied, postponed till after the election.

We name it a cash flood as a result of a deficit of 659 billion TL is foreseen within the 2023 finances. Solely 565 billion TL curiosity might be paid. So the cash will movement to usurers as we mentioned above. It’s apparent that such an enormous deficit might be coated by borrowing and value hikes. This implies inflation. Inflation means the lira’s depreciation and the greenback’s upward motion. As we mentioned above, finances deficit and money owed will improve CDS and change price will increase.

Sure, a flood of cash is coming, a flood of cash is coming, during which the supporters will swim and the residents will drown…

.

#flood #cash #coming #prepared