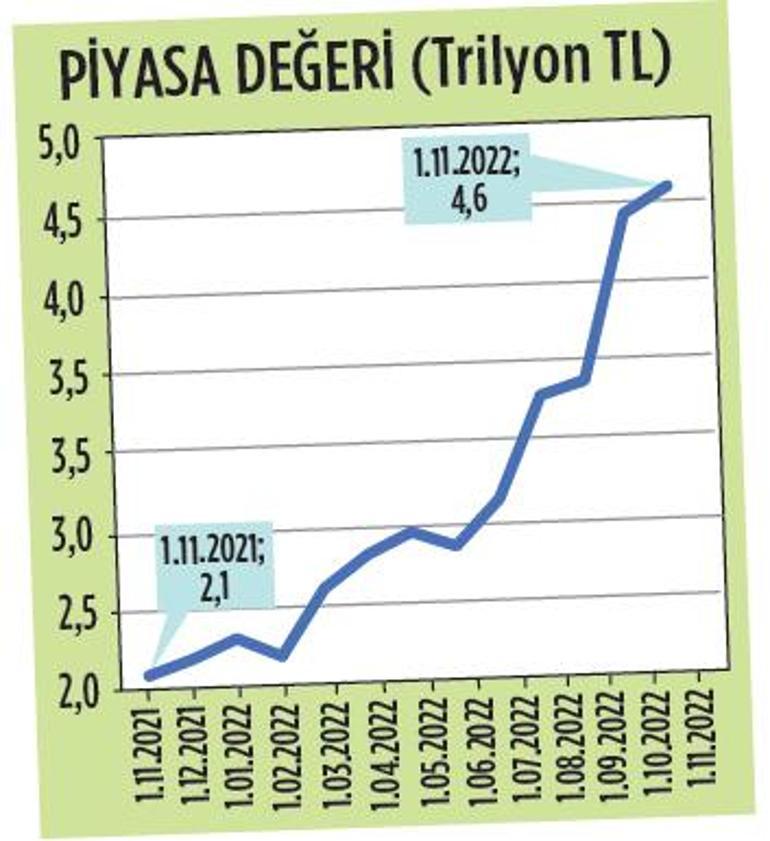

The overall market worth of the businesses within the inventory market is 4.6 trillion liras. In November 2021, the determine was 2.1 trillion TL. The market worth of firms within the inventory market doubled in a single 12 months

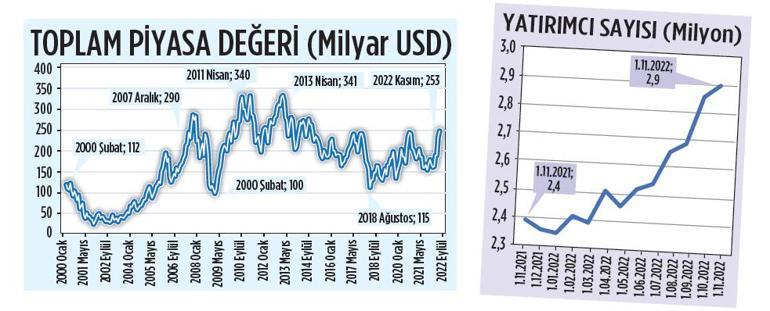

With the energy offered by the low rate of interest atmosphere, the inventory market is within the focus of each particular person and institutional traders. Curiosity will increase the variety of traders. The variety of traders, which was 2.4 million in November 2021, has now reached 2.9 million. Rising curiosity additionally will increase the worth of shares traded within the inventory alternate, whereas growing the worth of firms. In response to the most recent closing knowledge, the entire market worth of the businesses within the inventory market has reached 4.6 trillion liras. Undoubtedly, inflation has an impact on the speedy enhance within the determine. As a result of when evaluated in greenback phrases, the market worth of the businesses is equal to 253 billion {dollars}. This quantity reached the height stage of $341 billion in April 2013. In 2013, the entire variety of firms traded on the inventory alternate was 438. At present, 503 firms are traded on the inventory market. A complete of 503 firms have a market worth of $253 billion. Regardless of the growing quantity, the entire market worth of the businesses within the inventory market is beneath the 2013 values in greenback phrases.

Rate of interest drop impact

Final August, the entire market worth of firms within the inventory market in greenback phrases decreased to 115 billion {dollars}. This quantity was the second lowest complete market stage after $100 billion seen in 2009. At this stage, the CBRT’s price reduce from 14 % to 13 % in August was efficient in growing curiosity in shares with low valuation charges. After that, the regular decline in rates of interest continued. It was decreased to 12 % in September and 10.5 % in October. These circumstances offered an appropriate floor for the inventory market investor. Alternatively, excessive inflation allowed an inflation rally. The excessive returns on the principle shares that push the index up additionally appeal to new traders. As a result of the choices in various funding devices are restricted and the returns are low. Alternatively, there will likely be a interval by which traders will likely be extra selective within the stability sheet season.

Watch out for speculations

Traders have to make selective purchases with out getting excited concerning the excessive rises in shares. The interval we’re in can also be a interval of excessive enthusiasm, which paves the way in which for speculative actions in shares. Crucial query to be requested is: How will I be affected if I maintain the inventory I purchased in case of a attainable regression? Can I maintain it in my hand with peace of thoughts? The reply to this query may even enable the investor to be relieved of attainable hostile winds. In spite of everything, probably the most essential guidelines that shouldn’t be forgotten is that there might not at all times be ups and downs within the inventory market. The motivation of those that don’t promote within the intervals when income are realized shortly is instantly associated to the energy of the corporate.

highly effective tales

There is a chance within the inventory market, it is true. This can be a historic alternative. Nevertheless, it shouldn’t be missed that this chance is intently associated to the course of rates of interest. A attainable rate of interest motion after the election might result in a change in expectations. Because of this, firms which are sturdy and have a narrative needs to be chosen. Shares needs to be approached with a partnership logic.

Yields in sectors

Business is the sector with the best market worth on the premise of predominant sectors in Borsa Istanbul. The overall market worth of the businesses included within the BIST Business Index is 1 trillion 862 million TL. The monetary index is available in second, adopted by the service sector.

After we have a look at it on a sectoral foundation, the sector with the very best return for the reason that starting of the 12 months is BIST Chemistry, petroleum and plastics sector. Among the many sectors with a market worth of greater than 100 billion, the bottom returns are the Steel Important sector and the communication sector.

How a lot larger will Borsa Istanbul rise?

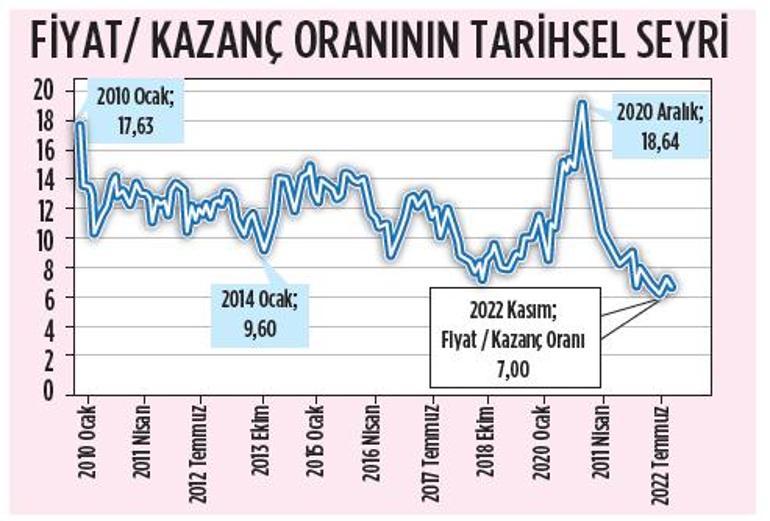

The value/earnings ratio is likely one of the essential knowledge used within the analysis of shares. The value/earnings ratio can also be expressed by the market cap/annual revenue ratio. Because of this, it exhibits the corporate’s one-year revenue and what number of years the principal is amortized. It’s seen that the typical worth/earnings ratio of firms traded in Borsa Istanbul has adopted a course within the vary of 10-15 previously years. It’s at present at stage 7. The present stage is nicely behind its previous averages. Borsa İstanbul nonetheless has an extended solution to go in accordance with the price-earnings ratio. Nevertheless, one other level that traders mustn’t ignore is that the impact of inflation can also be included within the costs.

After we have a look at the market worth, Borsa Istanbul had risen to 341 billion {dollars} in 2013. $253 billion now. Our present stage is even beneath the December 2007 stage. In December 2007, the typical market capitalization of listed firms was $290 billion.

Do irons make a premium?

The iron and metal trade was moved by the funding information of Ereğli Demir Çelik. Ereğli Demir Çelik made an essential assertion on its actions after the session on November 3, 2022. The corporate introduced that there’s a important quantity of iron ore in Ermaden’s mining web site in Bingöl-Avnik, the place it owns 90 % of the capital. Ereğli will due to this fact set up a manufacturing facility in Bingöl-Avnik. The impact of the funding on the inventory will likely be seen in the long term. With this side, it’s helpful for traders to set long-term objectives in entrance of them as an alternative of appearing within the very quick time period. Sectoral shares, which stay low on a sectoral foundation, will likely be on the radar of traders.

.

#Market #doubled #Zeynep #Aktaş