In line with the information of Sadettin Inan from Milli Gazete, Common Supervisor of Agricultural Credit score Cooperatives Hüseyin Aydın went down in historical past together with his lack of monetary foresight. The monetary lack of foresight of Hüseyin Aydın, who served because the Chairman of the Board of Administrators of Ziraat Financial institution and Halk Financial institution Common Directorate and the Banks Affiliation for a few years, and who is taken into account one of many main financiers of Turkey, precipitated the Agricultural Credit score Cooperatives to lose 1.1 billion liras in a brief interval of two.5 months. The sale of shares by the Common Supervisor, who, as quickly as he took workplace, stated, “Agricultural Credit score Cooperatives owe 35 billion liras,” and put every thing belonging to the farmer companions up on the market, price Agricultural Credit score very dearly. Regardless of his financier nature, the Common Supervisor’s lack of foresight in direction of Hektaş shares price Tarım Kredi 1.1 billion liras in 2.5 months.

AGRICULTURAL CREDIT SOLD, SHARES BROKEN 100 PERCENT

Hektaş shares, that are among the many favourite shares of Borsa Istanbul with the investments it has made within the agricultural sector in recent times, are one of many main shares held by brokerage homes of their portfolios. Agricultural Credit score Cooperatives bought 32 million 700 thousand Hektaş shares to OYAK at 33.74 liras with a 5 % low cost over the closing worth of Borsa Istanbul on 3 August. Hektaş shares, that are already in an upward development, continued to rise quickly after this sale (worth earlier than the capital enhance), reaching as much as 75 liras. On October 12, 150 % paid and 44 % free capital enhance was made, whereas the worth of the share was 25.40 liras yesterday. When the capital enhance is included, the worth of the share reaches 75 TL. The truth that Hektaş shares have been 100% premium in a brief interval of two.5 months after the Agricultural Credit score Cooperatives bought their shares reveals the shortage of foresight of the financier Common Supervisor. exceeded.

AYDIN SELL ITS AGRICULTURAL CREDIT SHARES, WHILE NEBATİ ADVERTISED ON THE STOCK EXCHANGE!

At a time when the Minister of Treasury and Finance, Nureddin Nebati, invited residents to put money into the inventory market and marketed the inventory market, the sale of Hektaş shares, which all brokerage homes gave funding recommendation, with the choice of Common Supervisor Hüseyin Aydın, and the nice loss skilled afterwards, the farmer group Tarım Kredi It reveals the extent to which the incompetence has reached.

WAS 3.8 PERCENT SHARE SOLD WITHOUT MARKET RESEARCH?

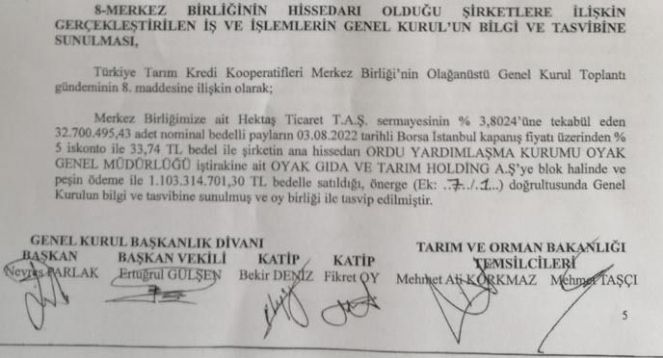

Whereas it’s questioned why the Agricultural Credit score Cooperatives ended its partnership with the agricultural firm Hektaş by promoting shares, it’s not identified based on which market analysis a critical share sale comparable to 3.8 % was made. Whereas the sale of shares, which was saved secret from the general public, was revealed within the minutes of the extraordinary normal meeting held on September 24, the truth that a market analysis for the sale of shares was not talked about within the minutes, revealing the scandal.

THE SALE ARISES IN THE MINUTES OF THE EXTRAORDINARY GENERAL ASSEMBLY, KEPT CONFIDENTIAL

Whereas Hüseyin Aydın, Common Supervisor of Agricultural Credit score Cooperatives, didn’t make any public assertion concerning the Hektaş share sale on 3 August, the share sale emerged within the minutes of the extraordinary normal meeting held on 24 September by the Central Union. The next statements concerning the sale of shares within the minutes of the extraordinary normal meeting drew consideration: “The shares with a nominal worth of 32 million 700 thousand, which corresponds to three.8 % of the capital of Hektaş Ticaret TAŞ belonging to our Central Union, belong to the affiliate of the OYAK Common Directorate of Ordu Assist Company, the primary shareholder of the corporate, with a 5 % low cost over the closing worth of Borsa Istanbul on 03.08.2022, with a worth of 33.74 TL. It was offered to the Common Meeting for info and approval consistent with the movement (Annex 7/1), and it was unanimously authorised that it was bought to OYAK Gıda ve Tarım Holding A.Ş.

AVOID LIABILITY BY CONFIDENTIALLY APPROVING THE SALE OF SHARES!

It was additionally noteworthy that the sale of shares, which is underneath the authority of the administration, was delivered to the agenda of the Common Meeting and authorised by the delegates. On the Extraordinary Common Meeting, solely the movement was voted on with out giving any clear info to the delegates concerning the sale, and Common Supervisor Hüseyin Aydın was relieved of his accountability for the injury he inflicted on Tarım Kredi because of the unpredictable sale of shares, because the delegates unanimously authorised the sale.

LOSE MORE THAN AYNES IN 2,5 MONTHS

Evaluating the quantity of agricultural loans made by the Agricultural Credit score Cooperatives to the farmers and the loss skilled within the sale of Hektaş shares of 785 million liras paid to the SDIF for the acquisition of AYNES, the extent of the loss suffered by the Agricultural Credit score is extra clearly understood. Whereas Agricultural Credit score Cooperatives made a complete of 11 billion liras of agricultural loans obtainable to farmers in 2021, 1.1 billion liras misplaced in Hektaş shares in 2.5 months corresponds to 10 % of the entire agricultural credit prolonged to the farmer. Then again, whereas the acquisition of Aynes was purchased for 785 million liras with the mortgage used fully from banks, the truth that more cash was recorded than the acquisition of AYNES because of the unpredictable share sale reveals the extent of the loss.

.

#expensive #establishment #Common #Supervisor #misplaced #billion #liras #months