While the CBRT announced that the interest rate was reduced from 14 percent to 13 percent last week, he drew attention to two points. First, it is closely monitored whether the growth rate of the loans and the financing resources accessed are developing in line with their purpose.

Secondly, it is observed that “the policy-credit rate gap, which has widened significantly recently, has reduced the effectiveness of monetary transmission”. It was denied before, now there is confession.

The first point shows that instead of directing the economy with known monetary instruments, the CBRT wants to direct the economy with special and sometimes poorly understood measures called “macroprudential measures” that can backfire.

In this context, new decisions are taken constantly. Decision makers have a hard time even following them, let alone making sound decisions.

The second point, as I said, is a confession; It is admitted that the so-called policy rate has no effect on other rates, and that the monetary transmission mechanism is not effective. The CBRT previously denied this situation. However, this was a result known to all interested parties.

Now, with the announcement made on 20 August 2022, the CBRT has again announced decisions “to support the effectiveness of the monetary transmission mechanism”. To what extent can these decisions, the number of which we no longer know, achieve their purpose? Are there any risks, especially in the outside world? First, let’s take a quick look at the decisions.

“Macroprudential measures” are being strengthened again

The main new resolutions are:

1) On April 23, 2022, for the loans with 20 percent reserve requirement, which has exceptions, 30 percent securities (government debt securities, GDBS) will be established to replace this reserve requirement.

2) From the end of July to the end of 2022, securities will be established for one year, equal to the loan amount exceeding the 10 percent loan growth rate.

3) 20 percent of the loan amount extended with an annual compound interest rate of 1.4 times the annual compound rate of the CBRT (16.32 percent) in commercial loans to be extended until the end of 2022; Securities up to 90 percent of the loan amount extended over 1.8 times will be established. CBRT (August 20, 2022).

Thus: a) In addition to the growth of the loan, the interest rate is also limited and it is tried to approach the CBRT interest rate.

b) The Treasury is required to borrow more easily and at lower interest rates.

c) Thus, it is aimed to reduce all kinds of “interest burden” for the economy.

Interest rates of borrowing with TL and eurobonds

At the end of the first day, on August 22, 2022, Turkey’s 2-year bond rate fell from 17.62 percent to 15.75 percent, and the 5-year interest rate from 16.77 to 13.84 percent. The yield on the 10-year bond, on the other hand, dropped by 300 basis points from 16.93 to 13.96. Bloomberg HT (August 22, 2022).

According to another source, the 10-year bond yield decreased by 235 basis points in the first day. Trading Economics (22 August 2022).

It is understood from this information that the Treasury’s TL borrowing interest will decrease. At least for now, the banks seem to agree to the desired limitations.

On the other hand, it is stated that Turkey’s eurobond bond yields (external borrowing interest) at different maturities are 11 percent or even higher. Intellinews (August 22, 2022). The CDS rate (risk premium of the 5-year bond), which is one of the factors determining these rates, seems to have increased again compared to the first indicators.

Global financial conditions, country conditions and CDS

On July 8, 2022, Fitch announced that it had downgraded Turkey’s credit rating from B+ to B. Because, it seemed difficult to improve exchange rate, inflation and macroeconomic stability with the mixed policies implemented.

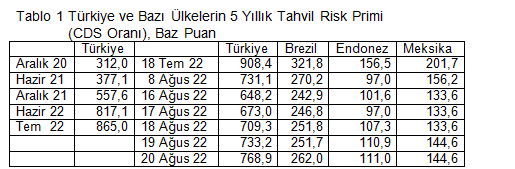

Then, as seen in Table 1, the 5-year bond’s risk premium, the CDS rate, increased to 908.4 basis points (9,084 percent) on July 18, 2022. Thus, the highest CDS rate of recent years was reached.

It was an expected result.

1) Turkey’s credit rating dropped, it was stated that other institutions would also downgrade.

2) Interest rates were rising in the world; Borrowing was becoming more costly and more difficult for debtor countries like Turkey. CDS rates rose in all countries.

3) International credit conditions were getting tighter and it was getting harder to obtain credit. For example, countries such as Lebanon and Sri Lanka have defaulted. It was said that countries such as El Salvador, Ecuador, Pakistan, and Argentina, which was said not to comply with the agreement despite the agreement with the IMF, would follow them.

Table 1 5-Year Bond Risk Premium of Turkey and Some Countries

Note and Source: The monthly values in the table are the average values of the last week of the month.

http://www.worldgovernmentbonds.com/cds-historical-data/turkey/5-years/

In mid-July, Bloomberg released a list of the 25 countries most likely to default. The following variables affected the default probability for this list;

one). Interest rate on government bonds issued in dollars (eurodollars),

2). CDS rate for 5-year bond

3). Interest expense as a rate of GDP (domestic and foreign)

4). Public debt as a ratio of GDP

Transferred; Visual Capitalist (July 13, 2022)

El Salvador, Ghana, Tunisia, Pakistan and Egypt are in the top 5 places on the Bloomberg list. Turkey is in the 20th place in the list of probability of default.

A remarkable development is: As seen in Table 1, the CDS rate of Turkey and other countries started to decrease as of the end of July. Moreover, on August 12, this time Moody’s downgraded Turkey’s credit rating from B2 to B3. The CDS rate continued to decline and fell to 648.2 on August 16, 2022.

However, the decrease in CDS rate was not unique to Turkey. CDS rates fell in all developing and developed countries except Poland, while Poland’s remained stable.

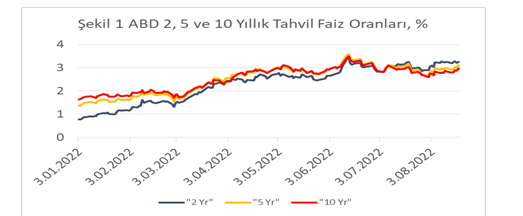

The rapid rise and then fall of CDS rates in all countries was a change in expectations for interest rate hikes and monetary tightening, led by the USA. Indeed, as Figure 1 shows, US interest rates rose until mid-June and then fell until mid-July.

Note and Source: The values in the figure are daily values from the beginning of 2022 to August 19.

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/

Therefore, the decrease in Turkey’s risk premium CDS was not a development provided by Turkey, but a global development. But let’s be careful, US interest rates started to rise again, especially in mid-August. We can see the result of this increase for 4 countries, including Turkey, on the right side of Table 1.

If you pay attention, Turkey’s CDS value is rising much faster than other countries. So, country-specific reasons are also determinant in CDS rates. An example of a country in this regard is Pakistan.

For Pakistan, at the end of July 2022, comments were made that it cannot find foreign currency for its foreign debts and imports, and is in default. Then Pakistan’s CDS rate jumped from the 1620s to 3486 (34.86 percent) on 9 August. However, on 10 August, with the news that the agreement with the IMF was finalized, CDS fell to 1744. Pakistan Tribune (12 August 2022)

CDS rates; global financial conditions, the country’s foreign currency debts and the country’s foreign currency payment capacity determine. CDS, on the other hand, affects the foreign borrowing rate. Monetary policies in Turkey should also take into account these effects and the evaluations of Turkey in the outside world. It doesn’t make sense to say we don’t deserve these reviews.

Source

Bloomberg HT (22 August 2022), Bond Rates

https://www.bloomberght.com/tahvil/faiz

Intellinews (August 22, 2022), https://www.intellinews.com/reports/turkey-country-report-aug22-august-2022-91266/

Pakistan Tribune (12 August 2022), “Pakistan’s risk of default on international payments, measured by the credit default swap 12 August 2022”

https://tribune.com.pk/story/2370696/default-risk-falls-sharply

CBRT (August 20, 2022), “Press Release on Macroprudential Measures”

https://www.tcmb.gov.tr/wps/wcm/connect/TR/TCMB+TR/Main+Menu/Duyurular/Basin/2022/DUY2022-36

Trading Economics (22 August 2022), https://tradingeconomics.com/bonds

Who is Ercan Uygur?One of Turkey’s leading economists, Prof. Dr. Ercan Uygur graduated from METU in the second half of the 1960s. After his graduation, he took the ‘assistant specialist’ exam at the State Planning Organization (DPT). However, four people who were successful in the exam, including Uygur, were not appointed. Uygur started to work in the Ministry of Finance, where he took the exam later. A year later, his application to the OECD for a two-year postgraduate scholarship was accepted after an interview to which he was invited. He received his master’s degree from the University of Warwick, England. He did his PhD at the University of East Anglia; Meanwhile, he taught ‘econometrics’ for a year. In 1977, he took the assistantship exam at the ‘econometrics’ chair at Ankara University, Faculty of Political Sciences (Property), Department of Economics and Finance; In the same year, he started to work in this chair. He went to this country with a nine-month scholarship from the Norwegian Government in 1981 for his associate professorship studies. Dr. He worked with Leif Johansen. On the day of the oral exam for associate professorship in Turkey, with the Law No. 1402 on Martial Law, two jury members, Prof. Dr. Tuncer Bulutay and Prof. Dr. The jury meeting, which could not be held when Nuri Karacan was suspended from the university, could only be held seven months later. One of Turkey’s leading economists, who was expelled from the university in the period following the September 12, 1980 coup, Prof. Uygur, who said Bulutay “You will stay at Mülkiye on behalf of us”, received the title of “associate professor” in 1983. He went to the USA with a Fulbright scholarship in 1988, Prof. Dr. Worked with Lawrence Klein on the LINK project. He received the title of ‘professor’ in 1989. He gave summer classes at Koç University between 1994-2012. He retired early from Mülkiye at the end of 2010. While he was a faculty member at Mülkiye, he advised the following institutions: – Islamic Countries Statistics, Economic and Social Research and Training Center (1986-1994) – Wharton Econometric Forecasting Associates (1988-1991) – Central Bank of the Republic of Turkey (1988-1993 and 1997-1998) – State Institute of Statistics, TURKSTAT (1990-1996) – ILO / International Labor Organization (project consultant, 1990) – TR Undersecretariat of Treasury (project consultant, 1992-1993 and 1997-1999) – World Bank (project consultant, 1999, 2002, 2009, 2010-2011) – United Nations ECE (project consultant, 1999-2000) – Third World Network (2009) Columnist for Yeni Yüzyıl newspaper (1995-1998), Head of Department of Economics at Mulkiye (1996-2008), Member of Ankara University Science Board (2002-2010), President of Turkish Economy Institution (2003 -2019), editor of Ekonomi-Tek magazine ( 2012-2020), International Final University Vice Rector and FEAS Dean (2016-2021). He was elected as a member of the Advisory Board of the International Economic Association (IEA) in 2011, and this duty still continues. In 2012 he was invited to become a member of the Kyoto Prize Advisory Board; He published 12 books in Turkish and English, including the editorship of which he was the editor, and wrote more than 50 scientific articles. Since September 2021, he has been writing a column for T24, which was founded and managed by his students from Mülkiye. prof. Dr. Ercan Uygur, 38 years of university life; In the Wednesday Talks of the Mülkiyeliler Derneği, to which he was invited on May 18, 2017, Prof. Dr. He sums it up with the title Tuncer Bulutay gave for his speech: “Student at METU, Professor at Mülkiye…” |