Friday, August 19, 2022

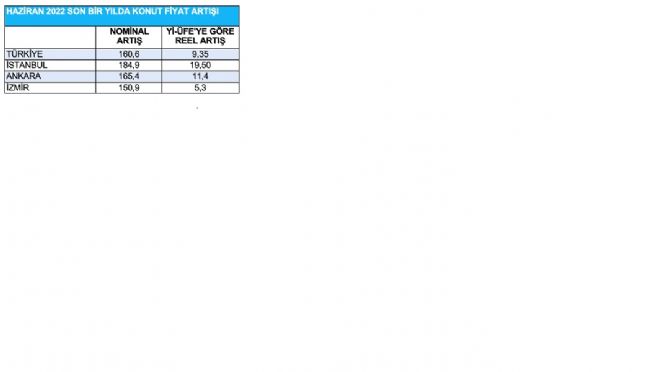

According to the Central Bank’s Housing Price Index; In the first six months of 2022, the average housing price index in Turkey increased by 160.6 percent compared to the same period of the previous year. The highest increase was in Antalya region with an increase rate of 200.2 percent.

First the pandemic and then the extreme depreciation of the TL in the last year were effective in the increase in housing prices.

Due to the pandemic, the demand for garden and detached houses has increased. Land prices in Çekmeköy – Ömerli, where I live, increased 4 times in a few months in 2020. Many detached houses have been built, but they are either not finished, the garden is finished and there is no occupant or it is up for sale.

In other words, the effect of the pandemic on housing prices will be completely removed this year.

According to the Central Bank’s Housing Price Index; The price of a house, which was 1 million liras in 2017 throughout Turkey, increased to 4 million 698 thousand liras in June 2022.

It is necessary to compare the housing price index with the cost-based D-PPI index, not the CPI index. As such, there has been a real increase in housing prices in the last year, but there has been no real increase in the last 4.5 years.

* If we take the D-PPI index as 2017 = 100; In June 2022, it was 549.2.

* If we take the Turkey average house price index as 2017 = 100, it was 469.8, lower in June 2022.

In summary; Housing prices have ballooned in the last year. In the last 4.5 years, it has increased less than D-PPI.

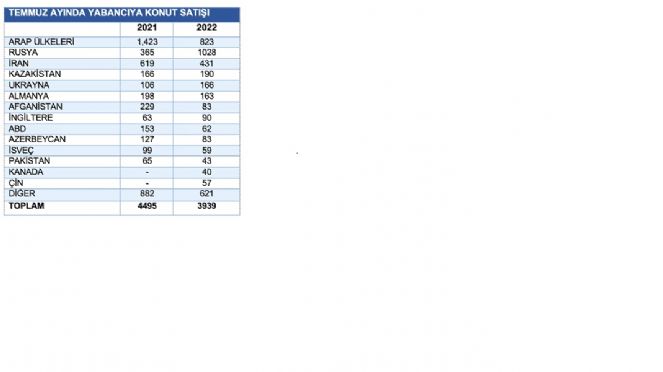

On the other hand, granting citizenship to foreigners in housing sales decreased the demand for housing from the West and increased the Arab housing demand. Last year and in July this year, one of the five houses was sold to Arabs.

What should happen next and what happens?

one. The government disrupted the housing market through TOKİ. TOKİ’s duty is to provide affordable social housing to the public. But both TOKİ and İBB Kiptaş before İmamoğlu turned to luxury housing and gave priority to supporters. Now, the government will build housing to TOKİ as an election investment. Housing problems escalate when electoral populism comes into play.

2. The Central Bank lowered the benchmark interest rate to 13 percent. This means that the negative interest rate in TL became minus 37.1 percent. The escape from TL increases the demand for housing. Money laundering also increases housing and real estate prices. Despite this, the exorbitant price increase that makes balloons in holiday regions such as Bodrum and Antalya will stop.

In the current situation, if those who save TL want to invest in a short term, for a year or two, housing is not an attractive investment. It would be more beneficial for them to make alternative investments until the bubble in housing prices falls.

.