The Central Financial institution lowered the coverage price to 10.50%. The inventory market index is at new file ranges with 3,934. So what shall be priced now? The stability sheet season has begun. Inventory market traders will value firms that posted good stability sheets within the third quarter, elevated their income and gross sales above inflation, and promising firms for the final quarter.

Inventory markets and inventory funds proceed to face out as an essential various for traders. The Central Financial institution of the Republic of Turkey (CBRT) minimize the coverage price by 150 foundation factors to 10.50 p.c. Wanting on the decision textual content of the CBRT, it’s noticed that it goals to finish the rate of interest minimize cycle after an analogous step was taken within the following assembly. With this resolution of the CBRT, it’s understood that cash will proceed to be addressed in basket funds and various devices. One among these addresses is the inventory market. Traders, however, will value the third-quarter stability sheets of firms within the inventory market.

Excessive efficiency

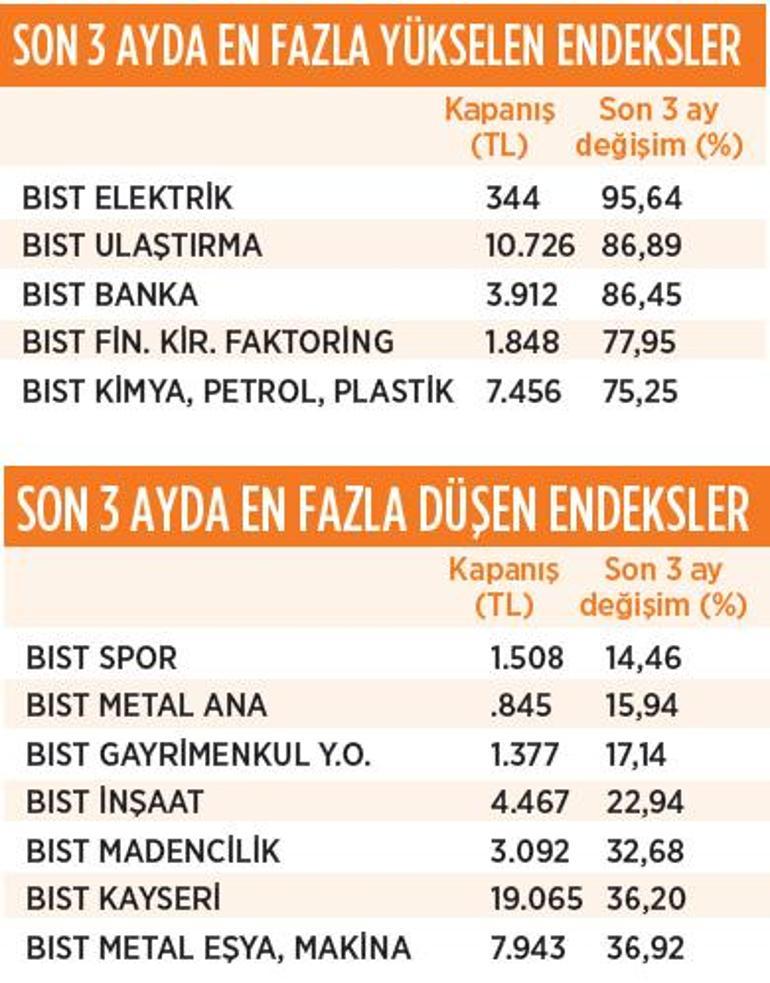

Vitality, banking, transportation and chemistry sectors confirmed the very best efficiency within the final three months. Shares within the vitality sector rose 95 p.c within the final three months. Transportation shares gained 86.8%. Banking sector shares made a premium of 86.4 p.c. Will increase had been noticed primarily within the monetary and repair sectors. Amongst these sectors, there have been firms that stood out in transportation and vitality. The expectations within the third quarter stability sheets of those firms are additionally optimistic.

poor efficiency

The 2 sectors which might be anticipated to carry out the weakest are the metallic core sector and the patron durables. Indices measuring the efficiency of each sectors additionally assist this prediction. BIST Steel Fundamental Sector shares have elevated by 15.94 p.c within the final 3 months. The rise within the metallic items sector, however, was stronger at 36 p.c. In the identical interval, BIST 100 Index elevated by 56.6 p.c.

10 firms introduced

10 firms in Borsa Istanbul shared their 9-month monetary statements with their traders. Among the many introduced stability sheets, the very best revenue belongs to Aselsan with 5.7 billion liras. Arçelik, however, made a revenue of 1.7 billion liras within the nine-month working interval.

The stability sheet of the nine-month actions of the three middleman establishments has additionally been introduced. Accordingly, whereas Data Funding made a revenue of 321 billion liras within the 9-month interval of the 12 months, it elevated its end-of-period revenue by 383 p.c. In the identical interval, Osmanlı Menkul introduced a revenue of 127 million liras.

The corporate elevated its revenue for the interval by 154 p.c.

Among the many middleman establishments that disclose their monetary statements, there are additionally those that make losses. Gedik Menkul Değerler grew to become the middleman establishment that introduced a loss throughout its nine-month working interval. The corporate introduced a lack of 60 million TL. In the identical interval of 2021, the corporate made a revenue of 146 million liras.

Fairness primarily based motion

Relying on the stability sheets to be introduced within the third quarter of the 12 months, reactions on the idea of shares shall be noticed. Reactions will be optimistic in addition to unfavourable. On this sense, stock-based fluctuations will change into extra distinguished within the upcoming interval within the inventory market.

Aselsan’s revenue is 5.7 billion TL

Aselsan shared its monetary statements with traders final week. The corporate elevated its revenue for the 9-month interval by 84.4 p.c to five.7 billion TL. The rise within the revenue for the interval is one level above the inflation price of 83.4 p.c. Whereas the inventory examined the bottom degree of 21.60 TL in July, it closed at 31.84 TL final Friday. It rose 2.25% within the final week. The stability sheet was introduced on the finish of the session on 19 October. Publish-balance sheet shares fell 2.09 p.c on the final day of the week.

Arçelik lowered its revenue

Arçelik introduced its monetary statements after the session on Friday. The corporate decreased its period-end revenue by 22.63 p.c within the 9-month interval of the 12 months. Its revenue fell from 2.2 billion liras to 1.7 billion liras. Regardless of the rise within the firm’s gross sales, rising monetary bills are efficient within the decline in revenue on the finish of the interval. Arçelik has quickly elevated each its short-term liabilities and financing bills since final 12 months. The truth that it meets its investments from exterior sources causes the expansion of each gadgets, whereas considerably decreasing its income. Displaying a powerful output within the first half of the 12 months, Arçelik reached the very best degree of 84.30 TL in June. Afterwards, revenue gross sales grew to become extra dominant. Whereas the inventory made a premium of two p.c on the final buying and selling day, it closed at 73.25 TL.

.

#Good #stability #sheets #priced #Zeynep #Aktaş