Thursday, October 13, 2022

Default in Exterior Money owed is the lack of the general public or personal sector to pay its exterior money owed on time.

In response to the information of Dünya Newspaper; Worldwide Credit score Score Company Fitch‘s official accountable for Financial institution Notes, among the many EMEA (Europe, Center East and Africa) area and CIS (Commonwealth of Unbiased States – Azerbaijan, Belarus, Armenia, Kazakhstan, Kyrgyzstan, Moldova, Uzbekistan, Russia and Tajikistan) nations are probably the most weak to foreign money dangers. He stated it was Turkey.

Usually, the worth of TL continues to be round 45 p.c decrease. For instance, if the Central Financial institution’s actual trade fee index was 100 (Equilibrium fee), one greenback must be 10 liras. Regardless of the low worth of TL, we can not forestall it from falling additional as a result of the dangers are very excessive in Turkey.

The most important drawback introduced by trade fee shocks is the rise in imported enter prices and inflation in parallel.

One other threat is the danger of default in exterior debt.

one. Actually, each issues created a course of that feeds one another. As a result of excessive inflation creates uncertainty, home and overseas capital doesn’t make investments, however quite the opposite. The overseas trade provide is shrinking and the trade fee is rising. Once more, the deterioration of worth stability accelerates the escape from the TL and dollarization, and the trade fee will increase once more.

This course of will increase the TL-denominated price of overseas debt and the danger of default.

2. Financing the present account deficit grew to become tougher.

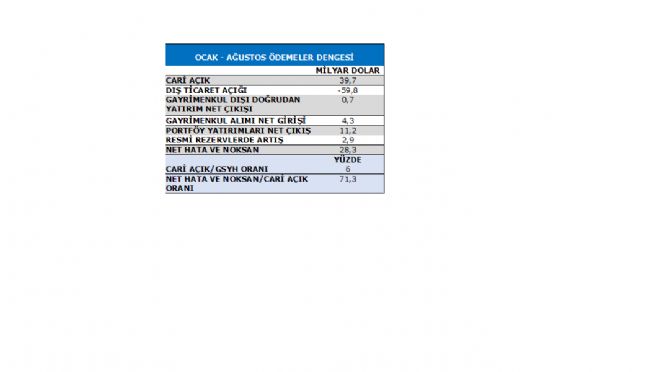

In January-August 8 months, the present account deficit was 39.7 billion {dollars}.

The present account deficit is financed both by long-term overseas direct funding capital or by exterior debt. International direct funding capital is one of the best ways as it’s everlasting for a very long time. Nevertheless, within the first 8 months, there was no overseas funding capital influx from Turkey, aside from actual property, and quite the opposite, 700 million {dollars} got here out.

Subsequently, the present account deficit will increase the exterior debt. The ratio of exterior debt to GDP in Turkey is round 57 p.c. It isn’t excessive, however as a result of the present account deficit continues, Turkey’s exterior debt fee capability is low. Furthermore, because of the excessive threat, CDS charges are excessive, round 800 foundation factors. Subsequently, the price of borrowing will increase. International debt is troublesome to roll over.

Furthermore, it’s understood that the present account deficit will proceed. TURKSTAT introduced that the phrases of commerce decreased to 73 in August. Which means that the costs of import items enhance greater than the costs of export items. Because of this, overseas commerce deficits are additionally growing.

Within the eight months of January-August, 71.3 p.c of the present account deficit, that’s, 28.3 billion {dollars}, occurred in web errors and omissions. This influx of cash, whose supply is unknown, is an answer for financing the present account deficit, however it’s also one of many fundamental the reason why Turkey is asserted fragile. Furthermore, financing the present account deficit can’t be sustained with web errors and omissions. As a result of such errors in overseas foreign money entry don’t encompass accounting weaknesses. There are clearly unregistered entries. These entries can be via the underground financial system. It’s already emphasised in worldwide platforms that the drug commerce in Turkey has elevated. The truth that the online error and omissions merchandise is so excessive will increase this chance. In addition to, tomorrow there could also be as a lot output as this entrance.

Vacationers coming from Germany to spend the winter because of the battle from Russia created an extra alternative for Turkey. Nevertheless, the share of this chance within the present account deficit, which will probably be over $50 billion this 12 months, will stay low.

However; The detrimental Central Financial institution reserves additionally elevated the danger of default in exterior debt.

Turkey’s exterior debt and surplus present account deficit to be paid inside a 12 months is 230 billion {dollars}. These money owed “By placing Ali’s hat on Veli and Veli’s hat on Ali” We can not translate.

If the federal government doesn’t take the matter significantly, go to the IMF and put together a stabilization program, we’ll default on overseas money owed with a 60-70 p.c chance till the elections.

.